interest rate floors what happens to premium analyst form

What is an Interest Rate Floor?

An interest charge per unit floor is the lower range of rates that is agreed upon, when a floating rate loan product is purchased from a lending establishment. They are besides found in many derivative products and are often used when computing and projecting risk.

When traders or borrowers seek to empathize their downside limit, the interest rate flooring can help them understand the level of run a risk they are taking on and the type of hedge they may wish to have on.

Adaptable-rate mortgages are a common instrument utilized past borrowers in the U.South. The interest rate floor instrument helps protect lenders from falling interest rates and secure a base minimum involvement accruement on their loan principal.

Interest rate floors are often purchased as a function of an interest rate collar. They are part of a hedging strategy that may be executed in society to protect against fluctuations in the market and more than accurately forecast cash flows for presentation to stakeholders and investors.

Summary

- Interest rate floors are mostly a contract between two parties that provide a floor on floating-rate payments.

- When traders or borrowers seek to empathize their downside limit, the interest charge per unit flooring can help them understand the level of risk they are taking on and its limits.

- Understanding at what value the floor should be set up is pivotal to utilizing an interest rate flooring effectively.

Understanding Involvement Charge per unit Floors

Interest charge per unit floors are also instruments that consist of a series of European put options on interest rates. They are called floorlets. The buyer of the instruments receives payments at the end of each predetermined period where the interest charge per unit falls below the strike price of the choice.

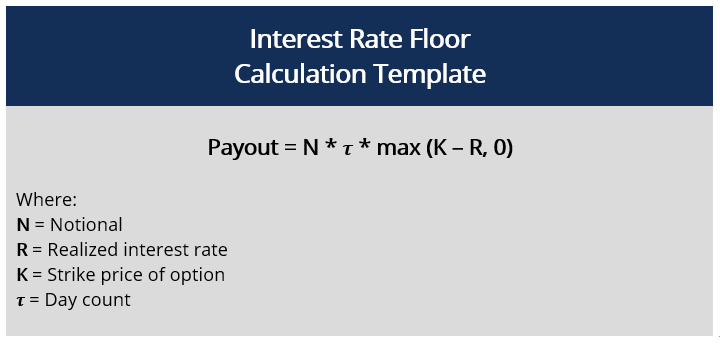

When purchased, an upfront premium is paid by the buyer to the seller. The involvement rate floor volition pay off according to the diagram below:

What Does an Involvement Rate Flooring Look Similar?

Permit us pretend for an instance that you are a corporate banker looking at underwriting a sizable loan for one of your larger business clients. They've requested to select a variable rate loan , assertive interest rates will probable drop for the period that they will be paying back the chief and interest.

Your internal strategy squad at your bank agrees that this is a possible scenario. You then determine that in order to mitigate against this possibility, yous will hedge your loan by buying an interest charge per unit flooring choice. This volition protect y'all from any lost involvement income if interest rates fall beneath the interest rate floor.

Downsides of an Interest Rate Floor

When lending large sums of money with variable rates, there are limited downsides to purchasing an interest rate flooring contract. Their protection is a useful form of insurance most lenders would exist prudent not to ignore. However, if the flooring is set to low, then the premium paid for this instrument may be considered a waste material.

Understanding at what value the floor should exist ready is pivotal to utilizing an interest rate floor finer. Without doing so, y'all may find yourself purchasing these types of instruments at ineffective rates relative to market fluctuations and possible involvement rate outcomes. As such, a broader understanding of the interest rate market is required in club to better understand how to construct this blazon of hedge.

Learn More

CFI offers the Certified Banking & Credit Analyst (CBCA)® certification program for those looking to take their careers to the next level. To continue learning and developing your knowledge base, please explore the boosted relevant resource below:

- Hedging

- Principal Payment

- Underwriting

- Price Floors and Ceilings

Source: https://corporatefinanceinstitute.com/resources/knowledge/credit/interest-rate-floor/

0 Response to "interest rate floors what happens to premium analyst form"

Post a Comment